API reference

@cached

This decorator can improve performance a lot. It will cache your functions / properties to avoid unnecessary computational intensive repetitions. Especially indicator calculations that are called often are perfect candidates for this. The cache is cleared every new candle behind the scene.

Example:

from jesse.strategies import Strategy, cached

@property

@cached

def donchian(self):

return ta.donchian(self.candles)WARNING

- If you use it with

@propertymake sure the order is right like above. Otherwise you will get an error. - Caching consumes a little time too. So to benefit from it the cached function/indicator should be slow and called multiple times in the strategy. Do tests whether it actually improves speed. Ignoring this warning and adding it to all functions most likely does more harm than good.

available_margin

available_margin represents the current margin available in your trading account. It is calculated as the balance minus the margin used for open positions and orders.

WARNING

available_margin is calculated by subtracting the margin used in open positions and orders from your account balance. For instance, if your balance is $10,000 and you have $2,000 tied up in trades with 2x leverage, the available margin would be $10,000 - ($2,000 / 2) = $9,000.

Return Type: float

See Also: leveraged_available_margin, balance

leveraged_available_margin

leveraged_available_margin is the same as self.available_margin except that it takes leverage into account in a way that is more intuitive for some traders. It is basically self.available_margin * self.leverage.

WARNING

leveraged_available_margin takes the account balance, multiplies it by the leverage, and then subtracts the margin used for open positions and orders. For example, with a $10,000 balance and $2,000 used in trades at 2x leverage, it would be calculated as ($10,000 * 2) - $2,000 = $18,000. This provides a realistic view of the margin available for new trades.

Return Type: float

See Also: available_margin, balance, leverage

average_entry_price

The average entry price estimated based on active orders(and not the open position). The word average indicates that in case you use multiple entry orders, this property returns the average value.

WARNING

average_entry_price is not necessarily the same as the entry_price of the open position. If you need open positions's average entry price, use self.position.entry_price.

Return Type: float

Example:

def go_long(self):

qty = 2

# self.average_entry_price is equal to (100 + 120) / 2 == 110

self.buy = [

(1, 100),

(1, 120)

]

self.stop_loss = qty, 80

self.take_profit = qty, 140

def filter_min_pnl(self):

min_pnl = 1

reward_per_qty = abs(self.average_take_profit - self.average_entry_price)

return (reward_per_qty / self.average_entry_price) * 100 > min_pnlWARNING

Note that average_entry_price is only available after go_long() or go_short() is executed. Hence, it is only supposed to be used in either filter functions or when the position is open.

In other words, you cannot use it inside should_long() and should_short().

See Also: average_take_profit, average_stop_loss

average_stop_loss

Same as average_entry_price but for stop-loss. The word average indicates that in case you use more than one point for stop-loss, this property returns the average value.

Return Type: float

See Also: average_entry_price, average_take_profit

average_take_profit

Same as average_entry_price but for take-profit. The word average indicates that in case you use more than one point for take-profit, this property returns the average value.

Return Type: float

See Also: average_entry_price, average_stop_loss

balance

Returns the current wallet in your exchange wallet. In the futures market, it behaves exactly as "wallet balance in USDT" does on Binance Futures.

Return Type: float

Aliases: capital

See Also: available_margin

portfolio_value

Returns the value (in the currency of your trading session. Usually it's USDT or USD) of your entire portfolio (all positions).

This is sometimes useful as self.balance is like the "wallet balance" on futures exchanges and only changes after the position is closed. But portfolio_value takes both open and closed positions into account.

Return Type: float

See Also: available_margin

daily_balances

Returns a list of daily balances of your portfolio. It is as if you were storing your portfolio's value each day using the self.portfolio_value property. It is used for calculation of metrics such as Sharpe Ratio, etc.

Return Type: List[float]

See Also: portfolio_value

close

Alias for price

current_candle

Returns the current candle in the form of a numpy array.

Return Type: np.ndarray

[

timestamp,

open,

close,

high,

low,

volume

]Example:

from pprint import pprint

pprint(self.current_candle)

# array([1.54638714e+12, 3.79409000e+03, 3.79714000e+03, 3.79800000e+03,

# 3.79400000e+03, 1.30908000e+02])

pprint(self.current_candle.dtype)

# dtype('float64')You could get timestamp, open, close, high, low, and volume from candle array:

timestamp = self.current_candle[0]

open_price = self.current_candle[1]

close_price = self.current_candle[2]

high_price = self.current_candle[3]

low_price = self.current_candle[4]

volume = self.current_candle[5]TIP

Just like in the API of crypto exchanges, and TradingView, each candle's timestamp is the beginning of that time period, not the ending but the actual time it began.

For example if you are trading the 5m timeframe and the current time is at 12:05:00, the current_candle's timestamp will show 12:00:00.

See Also: price, close, open, high, low

candles

This property returns candles for current trading exchange, symbol, and timeframe. Is it frequently used when using technical indicators because the first parameter for all indicators is candles.

Return Type: np.ndarray

Example:

# get SMA with a period of 8 for current trading route

sma8 = ta.sma(self.candles, 8)get_candles

This method returns candles for the exchange, symbol, and timeframe that you specify, unlike self.candles which returns candles for the current route.

get_candles(exchange: str, symbol: str, timeframe: str)For simple strategies that trade only one route and use only one timeframe, self.candles is probably the way to go. Otherwise, use self.get_candles().

Return Type: np.ndarray

Example:

@property

def big_trend(self):

"""

Uses the SRSI indicator to determine the bigger trend of the market.

The trading timeframe is "4h" so we use "1D" timeframe as the anchor timeframe.

"""

k, d = ta.srsi(self.get_candles(self.exchange, self.symbol, '1D'))

if k > d:

return 1

elif k < d:

return -1

else:

return 0See Also: candles

fee_rate

The fee_rate property returns the fee rate of the exchange your strategy is trading on. This property is most commonly used as a parameter for risk_to_qty.

Example:

qty = utils.risk_to_qty(self.balance, 3, entry, stop, fee_rate=self.fee_rate)Return Type: float

See Also: risk_to_qty

TIP

The fee_rate property returns exchange fee as a float. For example at Binance fee is 0.1%, hence self.fee_rate would return 0.001.

high

The current candle's high price.

Return Type: float

Example:

def go_long(self):

qty = 1

# open position at 2 dollars above current candle's high

self.buy = qty, self.high + 2increased_count

How many times has the position size been increased since this trade was opened?

This is useful for strategies that for example enter/exit in multiple points, and you'd like to update something related to it.

Return Type: int

This property is useful if:

- You have been trying to open position in more than one point:

def go_long(self):

self.buy = [

(0.5, self.price + 10),

# after this point self.increased_count will be 1

(0.5, self.price + 20),

# after this point self.increased_count will be 2

(0.5, self.price + 30),

# after this point self.increased_count will be 3

]- You decide to increase the size of the open position because of some factor of yours:

def update_position(self):

# momentum_rank being a method you've defined somewhere that

# examines the momentum of the current trend or something

if self.momentum_rank > 100:

if self.is_long:

# buy qty of 1 for the current price (MARKET order)

self.buy = 1, self.priceindex

The index property is a counter that can be used to detect how many times the strategy has been executed. Imagine we're in a loop in backtest mode, and this index represents the iteration of that loop. The examples below can provide a better explanation.

Return Type: int

Example:

# Example #1: Go long when the first candle is received

def should_long(self):

return self.index == 0

# Example #2: Suppose there are some expensive operations in a

# method I've defined called do_slow_updates() (like machine learning tasks)

# that I want to perform once a day while trading "1m" candles

def before(self):

if self.index % 1440 == 0:

do_slow_updates()has_long_entry_orders

Used to know the type of entry orders for times that position is not opened yet such as inside the should_cancel_entry() and before() methods and also in filters.

Return Type: bool

Example:

def should_cancel_entry(self):

# cancel entry orders only if trying to enter a long trade

if self.has_long_entry_orders:

return Truehas_short_entry_orders

Like has_long_entry_orders but for short trades.

Return Type: bool

is_close

Is the current position close?

Return Type: bool

Alias for self.position.is_close

is_long

Is the type of the open position (current trade) long?

Return Type: bool

is_open

Is the current position open?

Return Type: bool

Alias for self.position.is_open

is_short

Is the type of the open position (current trade) short?

Return Type: bool

exchange_type

Returns the type of the exchange your strategy is trading on. It will be either spot or futures.

Return Type: str

is_backtesting

Returns whether the strategy is running in backtest mode or not.

Return Type: bool

is_livetrading

Returns whether the strategy is running in live trading mode or not.

Return Type: bool

is_papertrading

Returns whether the strategy is running in paper trading mode or not.

Return Type: bool

is_live

Returns whether the strategy is running in either live trading or paper trading mode or not. It is the equivalent of:

self.is_livetrading or self.is_papertradingReturn Type: bool

is_spot_trading

Returns whether the exchange your strategy is trading on is a spot exchange.

Return Type: bool

is_futures_trading

Returns whether the exchange your strategy is trading on is a futures exchange.

Return Type: bool

leverage

The leverage property returns the leverage number that you have set in your config file for the exchange you're running inside the strategy. For spot markets, it always returns 1.

Return Type: int

liquidation_price

The liquidation_price property returns the price at which the position will get liquidated which is used in futures exchanges only. At the moment, backtests support the isolated mode only and not the cross mode.

In the live mode, the value for the liquidation_price is fetched from the exchange once every minute so what you see in the dashboard isn't updated in real-time.

Return Type: float

mark_price

The mark_price property returns the mark-price in futures exchanges which are used for the calculation of the liquidation price. This property is used for live trading futures exchanges only. During backtests, it equals to self.price.

Return Type: float

funding_rate

The funding_rate property returns the current funding rate in futures exchanges. This property is used for live trading futures exchanges only. During backtests, it equals 0.

Return Type: float

next_funding_timestamp

The next_funding_timestamp property returns the timestamp for the next funding. It is used only when trading perpetual contracts. This property is used for live trading futures exchanges only. During backtests, it equals None.

Return Type: int

liquidate

This method is used to quickly liquidate the open position using a market order. It is a shortcut to use instead of writing:

if self.position.pnl > 0:

self.take_profit = self.position.qty, self.price

else:

self.stop_loss = self.position.qty, self.priceIt is often used within the update_position method of strategies that close positions in specific conditions.

Example:

Let's open a long position at first index, and close it at 10th:

def update_position(self):

if self.index == 10:

self.liquidate()

def should_long(self):

return self.index == 0

def go_long(self):

self.buy = 1, self.pricelow

The current candle's low price.

Return Type: float

Example:

def go_long(self):

qty = 1

# open position at 2 dollars above current candle's low

self.buy = qty, self.high + 2

# stop-loss at 2 dollars below current candle's low

self.buy = qty, self.low - 2metrics

The metrics property returns the metrics that you usually would see at the end of backtests. It is useful for coding formulas such as Kelly Criterion.

WARNING

Be aware that without trades it will return None.

Available metrics:

- total

- total_winning_trades

- total_losing_trades

- starting_balance

- finishing_balance

- win_rate

- max_R

- min_R

- mean_R

- ratio_avg_win_loss

- longs_count

- longs_percentage

- short_percentage

- shorts_count

- fee

- net_profit

- net_profit_percentage

- average_win

- average_loss

- expectancy

- expectancy_percentage

- expected_net_profit_every_100_trades

- average_holding_period

- average_winning_holding_period

- average_losing_holding_period

- gross_profit

- gross_loss

- max_drawdown

- annual_return

- sharpe_ratio

- calmar_ratio

- sortino_ratio

- omega_ratio

- total_open_trades

- open_pl

- winning_streak

- losing_streak

- largest_losing_trade

- largest_winning_trade

- current_streak

Return Type: dict

open

The current candle's opening price.

Return Type: float

Example:

def should_long(self):

# go long if current candle is bullish

if self.close > self.open:

return True

return Falseorders

Returns all the orders submitted by this strategy.

Return Type: List[Order]

position

The position object of the trading route.

TIP

Please note that each route instance has only one position which is accessible inside the strategy. It doesn't mean that you cannot trade two positions using one strategy; to do that simply create two routes using the same strategy but with different symbols.

Return Type: Position

# only useful properties are mentioned

class Position:

# the (average) entry price of the position | None if position is close

entry_price: float

# the quantity of the current position | 0 if position is close

qty: float

# the timestamp of when the position opened | None if position is close

opened_at: float

# The value of open position

value: float

# The type of open position, which can be either short, long, or close

type: str

# The PNL of the position

pnl: float

# The PNL% of the position

pnl_percentage: float

# Is the current position open?

is_open: bool

# Is the current position close?

is_close: boolExample:

# if position is in profit by 10%, update stop-loss to break even

def update_position(self):

if self.position.pnl_percentage >= 10:

self.stop_loss = self.position.qty, self.position.entry_priceSee Also: is_long, is_short, is_open, is_close

all_positions

Returns a python dictionary with all the positions. The keys are the symbols and the values are the position objects.

Return Type: dict

Example:

# assuming that I have two trading routes, one for BTC-USDT and one for ETH-USDT

btc_position = self.all_positions['BTC-USDT']

eth_position = self.all_positions['ETH-USDT']See Also: position

price

The current/closing price of the trading symbol at the trading time frame.

Return Type: float

Aliases: close

Example:

def go_long(self):

# buy 1 share at the current price (MARKET order)

self.buy = 1, self.pricereduced_count

How many times has the position size been reduced since this trade was opened?

This is useful for strategies that for example exit in multiple points, and you'd like to update something related to it.

Return Type: int

Example:

def go_long(self):

self.buy = 1, self.price

self.stop_loss = 1, self.price - 10

self.take_profit = [

(0.5, self.price + 10),

(0.5, self.price + 20)

]

def update_position(self):

# even though we have especified the exit price

# for the second half, we now updated to exit with SMA20

if self.reduced_count > 0:

self.take_profit = 0.5, self.SMA20

@property

def SMA20(self):

return ta.sma(self.candles, 20)shared_vars

shared_vars is a dictionary object just like vars except that it is shared among all your routes.

You would need shared_vars for writing strategies that require more than one route, and when those routes need to communicate with each other.

shared_vars could act as a bridge. One example could be in a pairs trading strategy which requires two routes to communicate with each other (one goes long when the other goes short)

Return Type: dict

See Also: vars

time

The current execution timestamp (UTC) of the strategy.

Return Type: int

trades

Returns all the completed trades for this strategy.

Return Type: List[CompletedTrade]

vars

vars is the name of a dictionary object present in your strategy that you can use as a placeholder for your variables.

Of course, you could define your own variables inside __init__ instead, but that would bring a concern about naming your variables to prevent conflict with built-in variables and properties.

Using vars would also make it easier for debugging.

Return Type: dict

log

This method can be used to log text from within the strategy which is very helpful for debugging or monitoring (in case of live trading). Accepts a second log_type parameter with values as info or error.

The default is info. error logs are notified separately in the live mode, so that's a nice way of using them.

If you need to send a notification for the logged message in live mode, pass the send_notification parameter as True. For custom logs to custom channels, you can set webhook parameter with either a hard-coded webhook or an environment value from .env. Default is the General / Error channels.

log(

msg: str,

log_type: str = 'info',

send_notification: bool = False,

webhook: str = None

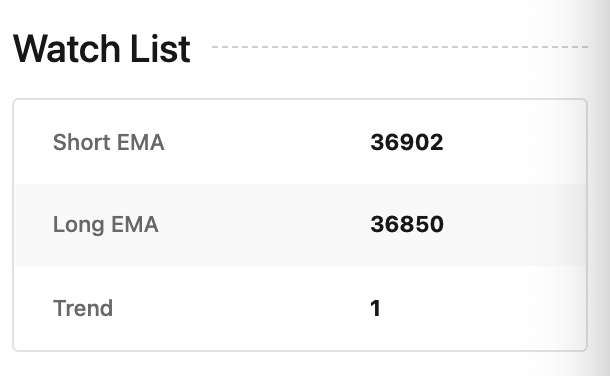

)watch_list

This method is to be used in live trading mode only:

watch_list() -> listReturn Type: list

Sometimes you might want to debug/monitor your running strategy constantly. One way to do that is to define the watch_list() method in your strategy which returns a list of tuples containing keys and values. You can fill anything you want in it; indicator values, entry/exit signals, etc.

Example:

@property

def short_ema(self):

return ta.ema(self.candles, 50)

@property

def long_ema(self):

return ta.ema(self.candles, 100)

def watch_list(self):

return [

('Short EMA', self.short_ema),

('Long EMA', self.long_ema),

('Trend', 1 if self.short_ema > self.long_ema else -1),

]Then, when you run the live session, you will see a new table like:

min_qty

The minimum quantity that you can trade on the exchange for the symbol you're trading. It is available in live and paper trading modes only.

Return Type: float