Filters

Filter functions are used to filter out bad trades.

Basic syntax

First, add the filters() method to your strategy class which must return a list:

def filters(self):

return []Then define filter methods as many as you need. They can have any name, but it is recommended to include the word filter in it:

def filter_1(self):

return abs(self.price - self.long_EMA) < abs(self.price - self.longer_EMA)And then add the method's object to the filters method's list:

def filters(self):

return [

self.filter_1

]DANGER

Notice that you must only add the method's object to the list. Do not call the method! (no parentheses at the end of the method name)

Wrong example:

def filters(self):

return [

self.filter_1()

]Why filters?

There are two reasons for using them:

1. To keep entry rules clean

Having so many conditional statements in should_long()/should_short() is not good practice.

You should keep your entry rules as simple as possible. You can then add filters per each special condition that you would like to avoid.

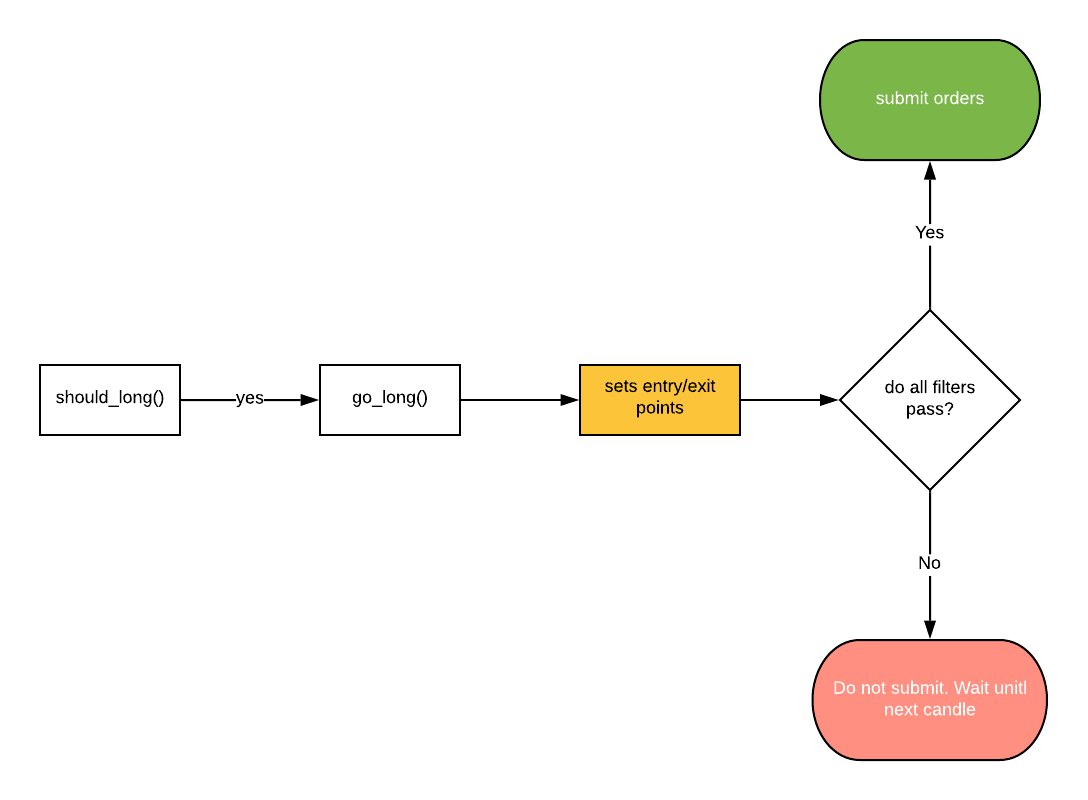

2. Filters have access to entry and exit points

Entry rules are defined in should_long() and should_short() functions; however entry and exit points are defined in go_long() and go_short() functions. That means if you need to evaluate a condition based on entry and exit points, you have to do it in a filter instead.

They say a picture worths a thousand words:

For example let's write a filter that makes sure the minimum PNL for trades is bigger than 1%:

def minimum_pnl_filter(self):

reward_per_qty = abs(self.average_take_profit - self.average_entry_price)

pnl_percentage = (reward_per_qty / self.average_entry_price) * 100

return pnl_percentage > 1Notice that we are using self.average_entry_price and self.average_take_profit properties which were not available inside should_long() methods.

3. Easier debugging

When a filter prevents opening a trade by not passing, it gets logged which is helpful for debugging.