Preventing Overfitting

When it comes to optimization, overfitting is probably the biggest danger. There are many ways to handle it, here is the method that we suggest:

Divide your dataset (of candles) into 3 periods. Training, testing, and validation. Here is a step-by-step example:

Imagine that you want to optimize your strategy for a period of 2 years (24 months). Let's say that two years is from 2018-01-01 to 2020-01-01. First cut a 6 months period of data preferably from the end of that period. We'll later use this dataset for validation.

Now start the optimize mode for 2018-01-01 to 2019-06-30.

Behind the scenes, Jesse divides this dataset into two periods; training(85%) and testing(15%). The training period is what Jesse uses to optimize the strategy's parameters. The testing period is merely a period that gets backtested at the same time as the training period. Why? Because if a DNA string is performing well on both training and testing periods, there's a good chance that it will perform well overall.

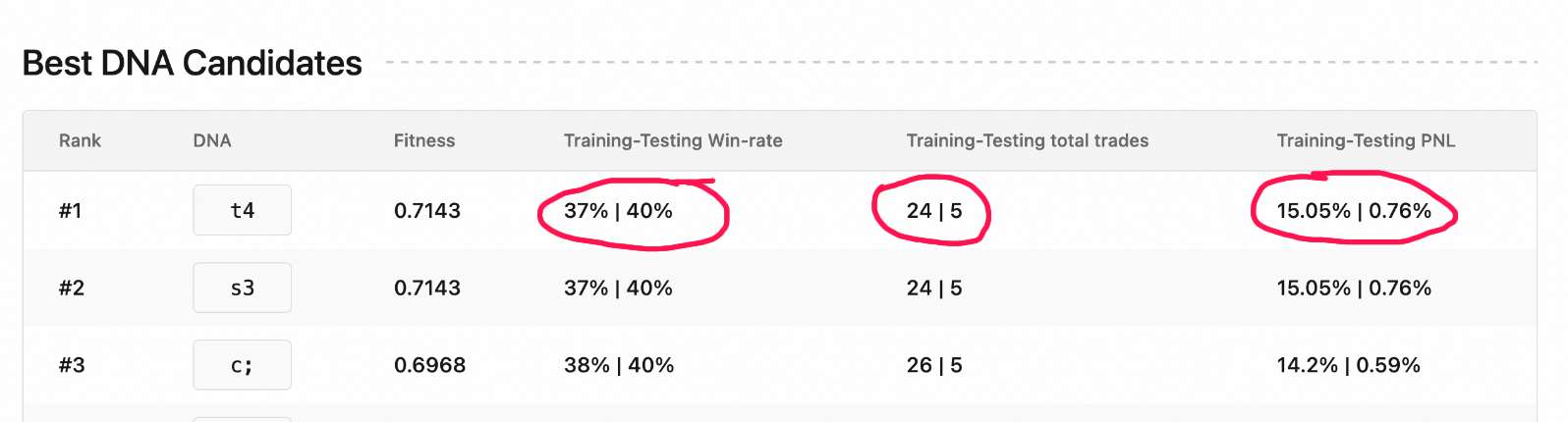

In the optimize mode's dashboard, metrics such as the win-rate and PNL are shown for both Training and Testing periods, and are divided by the | symbol:

Since DNAs have been ranked from best to worst, you will usually find good ones at the beginning. Try to choose the ones that have good metrics for both Training and Testing periods. Then, inject them into your strategy and backtest each of the good ones on the validation period which we set aside earlier. In our example that 6 month period is from 2019-07-01 to 2020-01-01.

If you got good results using the new DNA during the validation period, chances are that your strategy is not over-fit, because the optimization mode had only used the training period; it did not see/use the data for testing and validation periods.